nys workers comp taxes

ET Thursday October 6 2022 through 700 am. 20 Park Street Albany NY 12207 518-474-6670 NY Workers Compensation Board.

Workers Compensation Application For Judgment March 19 2020 Trellis

NYS Workers Compensation Board - Home Page.

. New York State Workers Compensation Board. If Board intervention is necessary it will determine whether that insurer will reimburse for cash benefits. 160 Broadway 10th Floor New York NY 10036 212 563-1900.

While a worker does need to report these benefits on New York tax form W-2 Wage and Tax Statements the amount awarded by the New York State Workers. Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of. Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable.

Workers Comp Exemptions in New York. Payable to the New York State Department of Taxation and Finance within two and one half months of the close of the reporting period Tax Law Article 33. ET Friday October 7 2022.

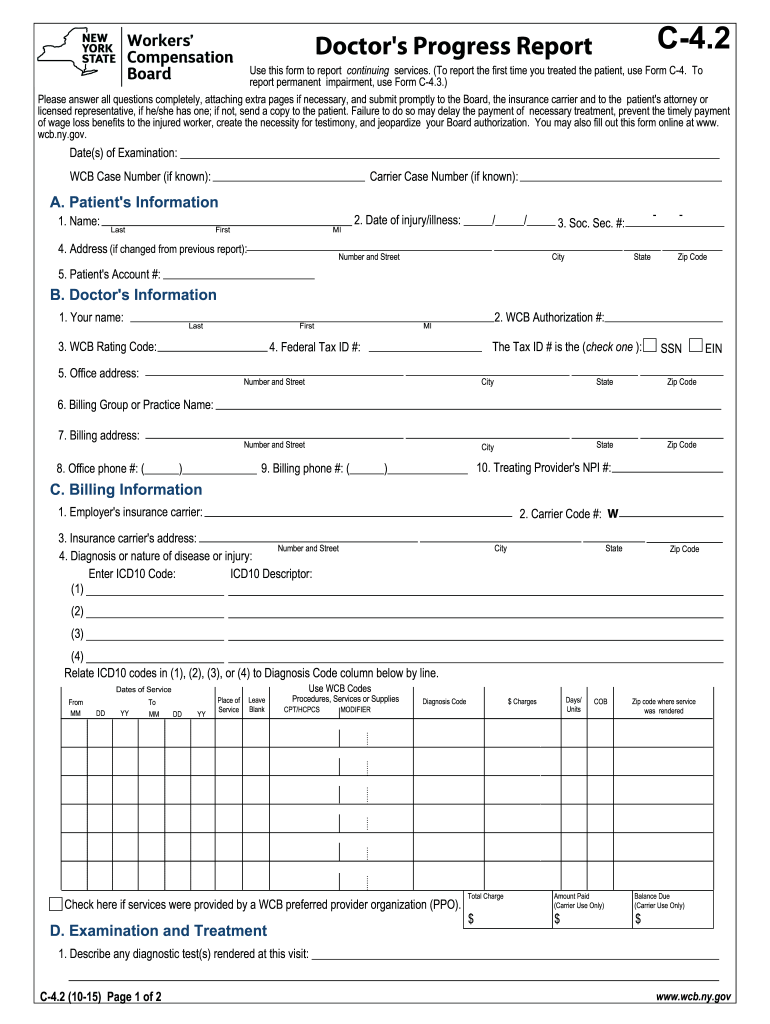

Prior authorization requests with a due date of October 6. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors.

The quick answer is that generally workers compensation benefits. According to IRS Publication 525 page 19 workers comp does not generally count as earned income for federal income tax purposes. OnBoard will be temporarily unavailable for scheduled maintenance from 600 pm.

The IRS in Publication 907 specifically states that workers compensation benefits for job-related sicknesses or injuries are not taxable. The amount you receive as workers. Information for Employers regarding Workers Compensation Coverage.

This tax exempt status applies if the worker receives. Workers compensation excludable earnings will be calculated and processed every pay cycle beginning with Administration paychecks dated 81215 and. Is Workers Compensation considered income when filing.

Workers compensation insurance is mandatory for most employers of one or more employees. Wages and salaries including retroactive pay compensation added to a paycheck if an employee was underpaid for some reason Overtime or double time pay at the employees base rate. The Workers Compensation Board is a state agency that processes the claims.

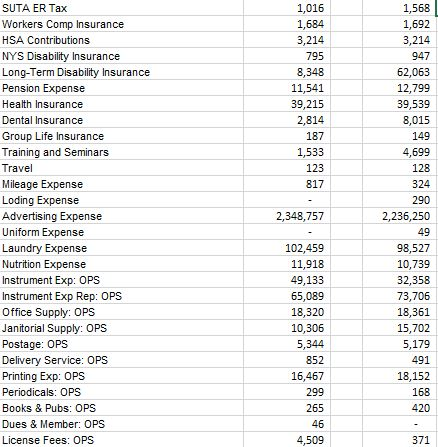

New York State Insurance Fund- SIF. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees. The Advocate for Business offers educational presentations on topics important to business such as an.

It protects employers from liability for on-the-job injury or illness and provides the following. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

Is Workers Comp Taxable What To Know For 2022

Workers Compensation Insurance Quotes Coverage Options

Are Workers Compensation Benefits Taxable In New York

Workers Comp 101 Do Employers Have To Pay For Workers Compensation

Is Workers Comp Taxable Workers Comp Taxes

A Complete Guide To New York Payroll Taxes

2022 Federal State Payroll Tax Rates For Employers

Based On The Trial Balance Create A Income Statement Chegg Com

Ny Workers Compensation Insurance Get Insured Fast

Services Global Accounting Services Cpa Pc

Workers Comp Settlement Chart Average Payout Expectations

Remote Workers May Owe New York Income Tax Even If They Haven T Set Foot In The State Marks Paneth

C3 Form Fill Online Printable Fillable Blank Pdffiller

![]()

N Y Lawmakers Aim To Give Real Estate Tax Exemption To Injured Workers Business Insurance

New York Hourly Paycheck Calculator Gusto

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law

C4 Form Fill Out Sign Online Dochub

Government Affairs Weekly Updates Week Of February 13 2017 Macny